|

|

|

Select your vehicle to see available coverage options:

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

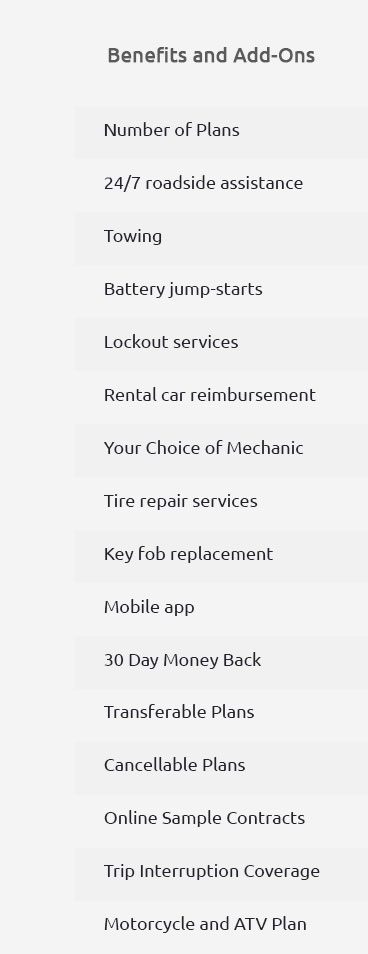

Car Repair Cover: A Comprehensive Coverage GuideExploring car repair cover can be daunting, especially for U.S. consumers seeking peace of mind on the road. Understanding vehicle protection options, repair costs, and extended auto warranties is crucial. This guide will navigate these aspects to help you make informed decisions about your car's future. Understanding Car Repair CoverCar repair cover is essential for anyone who wants to avoid unexpected repair costs. It provides financial protection against mechanical failures and breakdowns, ensuring you are not burdened with expensive repair bills. Benefits of Car Repair Cover

What Does It Cover?Car repair cover typically includes:

For specific coverage details, it's best to review your policy or explore options like the nissan auto extended warranty for tailored protection. Choosing the Right CoverageWhen selecting car repair cover, consider:

Exploring used auto extended warranty reviews can also provide insights into what to expect from different providers. FAQs

https://www.endurancewarranty.com/faq/general-help/why-is-mechanical-breakdown-insurance-only-offered-in-california/

Like an auto protection plan or extended warranty, mechanical breakdown insurance provides coverage for the costs of repairs of mechanical malfunctions that are ... https://carshield.com/usatoday/

Your monthly cost is based on the year, make, model and mileage of your vehicle. Prices start as low as $99 per month. https://consumer.ftc.gov/articles/auto-warranties-and-auto-service-contracts

Some auto service contracts will extend the length or coverage of the warranty that came with your vehicle, and others will cover some maintenance tasks like ...

|